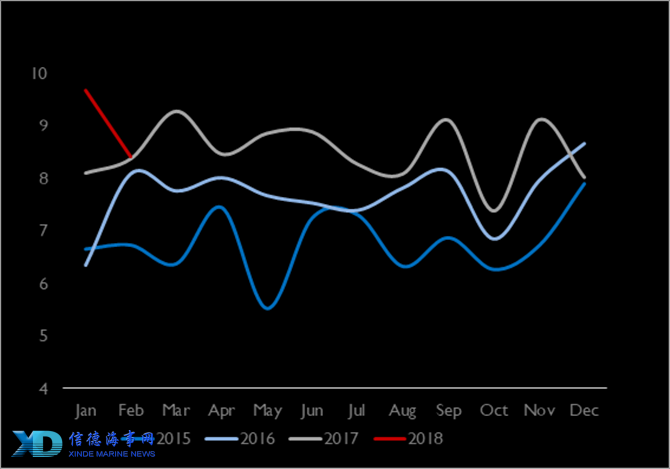

China’s February crude oil imports fell sharply to 8.41mbpd from January’s imports, that was almost 13% less than January’s record high imports of 9.66mbpd. One reason was due to higher imports prior to Chinese new year normally followed by a drop in imports during the national holiday period. The other reason was teapot refineries curbed buying amid worries about the new taxation system starts operation in March.

The new tax regulation is seen as a government effort to close a loophole that allegedly allowed teapot refineries to sell fuel without paying consumption taxes. As we know that teapot refineries have exerted the huge influence on the growth of Chinese crude oil imports in the past two years, and they helped to lift Chinese crude imports to a new record in January. The new tax rules will increase the tax compliance which may reduce the profit margins for these teapot refineries, hence hold them back from purchasing more cargoes for now. This may drag down the import volumes in the first quarter, but more refining capacity is added as well as falling domestic output and continue SPR building, we shall still expect to see higher Chinese crude imports for the full-year period.

Sources:Arrow

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

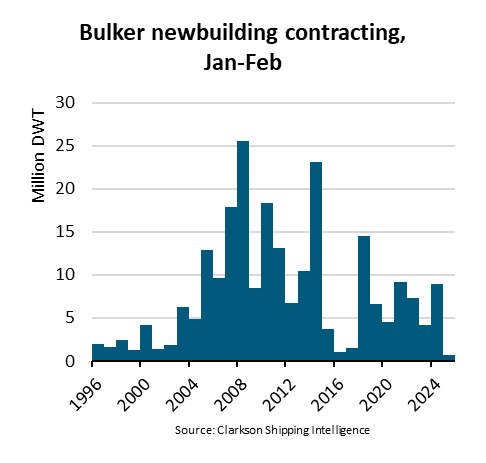

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar