Decades of dependence on coal has caused the northern region of China to be choked by heavy pollution without fail every year, directly impacting its citizen’s health and the overall image of the capital.

When President Xi Jinping came to power in 2013, he implemented steadfast measures ensuring his policies made a difference. One of the directives was the call for “War on pollution” which set forward the drive for a cleaner environment. In accordance, a series of initiatives has been set by the government to ensure national targets are met.

Fast forwarding to 2017, Chinese policy driven economy has started to significantly improve the environmental conditions as emissions from energy use declined for 2 years consecutively. As any policy implementation, there will be expected hiccups, but ultimately the intended targets are being achieved. Polluting coal consumers are either being shut down or replaced with highly efficient and less polluting counterparts.

Evidently, BP’s 2017 Outlook Report on the Chinese coal production showed a decline of 7.9% with an overall decline of 1.6% on the coal consumption. The Chinese war on pollution is being implemented through many fronts and natural gas has become a practical alternative as BP’s 2017 outlook showed a clear 7.7% growth in natural gas consumption compensating for coal’s reduction.

Several initiatives are being implemented in China to ensure the rebalancing of the energy fuel mix to support the ever-increasing energy demand. Leveraging the policies set by the government, state-owned energy enterprises with local governments strategically invested in the natural gas and LNG supply chain to secure supply. This move is similar to how the Japanese and Korean government’s strategic investments in LNG plants worldwide securing the respective country’s energy supply.

1. Fuel Source – Strategically securing long-term resources via investments in liquefaction plants in nations with proven reserves, the Chinese seem to have secured energy reserves to fuel continuous growth. Apart from securing direct investments, the Chinese banks have extended facilities to LNG projects worldwide by providing critical loans to support its development. The total value of loans provided from 2014 to 2016 exceeds USD 13 billion, clearly showing Chinese government's pushing towards LNG development. The world’s liquefaction nameplate capacity is expected to hit 450 MTPA within the next 2 years and at least 850 MTPA in capacity has been proposed. With the potential abundance in supplies, LNG can be expected to be a cost-effective power generation solution in coming years.

2. Transportation – Investments into LNG shipping and breakbulk facilities have also been ramped up. If the targeted first phase which involves 71 Chinese LNG receiving terminals were to operate at its maximum designed receiving capacity of 90 MTPA, approximately 100 new large-scale LNG carriers will be required to support the operations. Realizing the potential demand for shipping and breakbulk LNG, local Chinese shipyards have ramped up their LNG expertise and have started building locally to support the drive.

3. Receiving Terminals – The latest LNG blueprint issued by the Chinese government has two planned LNG terminal development phases. Phase 1’s total planned capacity will have 90.121 MTPA upon completion which can supply 124.367 BCM natural gas each year to downstream markets. The planned Phase 2 further expands the terminal capacities to 188.978 MTPA, effectively doubling the phase 1 capacity in anticipation of the energy mix rebalancing. The phases indicate planned in-land LNG terminals that support LNG breakbulk capability which requires small-scale LNG shipping and in-land distribution network.

Overall, the Chinese demand augurs well for the LNG industry as demand will support development. President Xi Jinping’s environmental protection commitment has shown clear improvements in the reduction of coal production and an overall drop in emissions in accordance with World Resources Institute. Balancing the energy mix will take time, albeit change is afoot.

Sources: Ramesh Nair,Director,Commercial-LNG,Wison Offshore & Marine

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

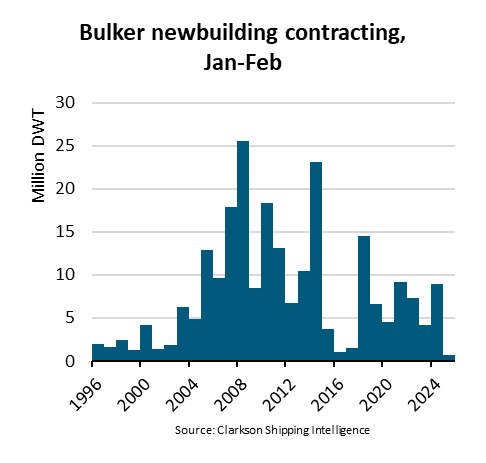

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar