China's steel rebar futures hit their highest in 10 months on July 12 amid potential tight supply as the government intensifies efforts to clean up the environment.

On July 11, China's cabinet launched a new cross-ministerial leadership group, headed by the vice-premier Han Zheng, to help draw up plans to tackle air pollution in northern regions.

"The high-class leadership group will certainly be a strong deterrent to environmental violations and may also restrain output at mills and mines," said Zhuo Guiqiu, an analyst at Jinrui Futures.

And Tangshan, China's biggest steelmaking city, has ordered steel mills, coke producers and utilities to cut output further for six weeks from July 20 until August 31 to improve its notorious air quality.

"With high environmental pressure, more regions may order their industrial plants to reduce emissions," said Zhuo.

The most-active rebar contracts on the Shanghai Futures Exchange had risen 2.1% after earlier touching 3,960 yuan/t ($591.24/t), its highest level since September 6.

Spot steel prices edged up 0.2% to 4,320.36 yuan/t on July 11, data showed.

Daily crude steel output by major steel companies over June 21-30 reached 1.96 million tonnes, down 1.8% compared to mid-June, data from China Iron & Steel Association (CISA) showed on July 11.

Steel inventory at mills dropped over the same period, falling 24,700 tonnes to 11.42 million tonnes, CISA data showed.

Prices for steelmaking raw ingredients also climbed. The most-traded coking coal contract for September delivery rose 2.2% to 1,157 yuan/t. Coke futures were up 2.3% at 2,065 yuan/t at 0214 GMT.

Dalian iron ore futures gained 1.6% to 464 yuan/t, with investors saying increased profit margins at mills would offer some support to the raw material.

Sources:sxcoal

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

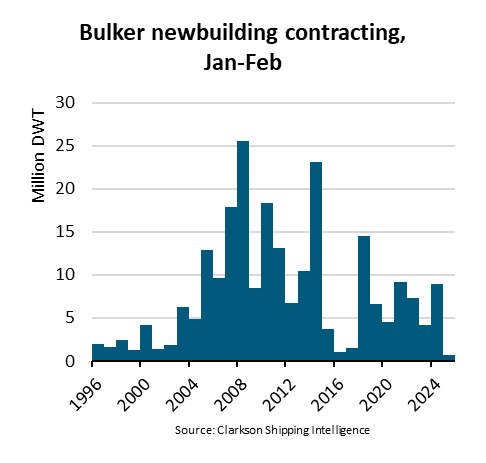

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar