Capesize

A shaky start to the week in Asia where rates on the key West Australia/China run lost almost 90 cents dropping to $8.30. However, ongoing interest from the miners and operators saw levels regain ground with the expectation of over $9.00 on the cards, with some suggesting timecharter business was done, which equated to $9.10. Timecharter rates fluctuated from around $18,000 daily to the low $20,000s daily, but a 2014-built 181,000-tonner agreed a strong $24,000 daily for a West Australian round, with a 2011-built 176,000-tonner achieving $21,000 daily mid-week for similar business. Charterers had been holding off in the expectation of rates easing, but steady levels from Brazil continued to attract ballasters, prompting several to fix at higher numbers. Two August 170,000-tonne 10% cargoes fixed from Saldanha Bay to Qingdao at a sharply higher $16.00. The Brazil/China rate settled most of the week in the low $20.00s but some brokers suggested rates were set to rise and expected Vale to sweep up ships for August. The North Atlantic market, often a case of feast or famine, saw a feast this week as an influx of new business combined with a tight tonnage list prompted significant rates rises, particularly fronthaul, where voyage cargoes fixed from St. Lawrence to the East showed a return of around $40,000 daily. This in turn supported transatlantic rates with ships here fixing in the upper $20,000-$30,000 daily range. A strong paper market lent support to period interest with a well described 179,000-tonner 2016-built open China fixing for six to nine months trading at $24,000 or $24,500.

Panamax

Like the football, last week was a game of two halves. Rates in the Atlantic took off as a combination of a reduced tonnage supply in the North coupled with increased mineral transatlantic trades and several front haul stems from various alternative loading areas to East coast South America fuelled the bull’s optimism. Whilst rates jumped dramatically especially for trips to the East and short Baltic/Murmansk rounds, very quickly doubts began to surface as multiple ships were failed on subjects which then divided opinion on market direction towards the end of the week. Rates concluded around $25,000 were circulated for trips East for Kamsamaxes and $23,000 for grain clean Panamaxes, whilst several Panamaxes fixed at $16,000 for short rounds on the North Continent. East coast South America has been comparatively slow last week with rates remaining flat at around $16,000 plus $600,000 ballast bonus. Meanwhile, the Pacific has been rather dull and uninspiring. Rates came under pressure in the North due to a lack of fresh enquiry, with only Indonesian and Australian mineral demand remaining buoyant, but rates slowly slipped lower throughout the week. Despite this, period interest has been strong and rates continued to defy the spot market with modern Kamsarmaxes fixing at around $14,000 for periods of around seven to nine months delivery in the East.

Supramax

Another week of diverging markets, with rates in the Atlantic gaining ground whilst the Asian routes lost support. Very limited period activity was discussed although a 63,500-dwt open CJK was failed on subjects at $12,750 for four to six months trading.

The Atlantic gained momentum last week with more activity from key areas including the US Gulf and South America and also the Eastern Mediterranean areas. An Ultra 63,300-dwt was reported fixed for a trip from the US Gulf with petroleum coke to Turkey at $18,500. From the Eastern Mediterranean, a 56,300 was linked to a trip from Canakkale to Indonesia in the mid-$18,000s. As the week progressed more activity was rumoured from East coast South America and a 60,000 dwt was linked to a fronthaul in the low $15,000s plus a $230,000 ballast bonus.

In contrast the Asian basin lacked impetus. A 63,300 was fixed delivery Kosichang trip via Indonesia redelivery China at $10,500 and a 56,000-dwt was fixed delivery Singapore for a trip via Indonesia redelivery Southeast Asia at $10,000. Nickel ore runs saw a 56,000-dwt fix trip via the Philippines redelivery China at $9,000. Limited activity was seen on NoPac business but a 63,400-dwt was reportedly booked delivery China for a trip via NoPac redelivery South China at $11,500. From China, a 56,700 was fixed delivery CJK for a trip redelivery Arabian Gulf at $9,000. Again little information emerged from the Indian Ocean area. A 55,300-dwt was reported fixed delivery Maputo mid-July trip redelivery Singapore-Japan at $12,000 plus $200,000 ballast bonus.

Handysize

The handy index slightly recovered and the market began to see a ray of hope especially in the Atlantic. It started from mid-week with more cargo appearing on East coast South America and the US Gulf area, but sentiment in the Pacific was still weak with little reported. A 32,000-dwt 2010-built was fixed to move grain to West Africa at $11,500 basis delivery La Pallice, France. A 45,000-dwt 2002-built was fixed at $14,000 from Turkey for a trip to West coast Mexico. Inter-Mediterranean business was reportedly booked around $6,000 on handy vessel but rates were said to have improved towards the end of the week, and coastal trips along East coast South America were reported to have set a level at above $10,000 per day. From the US Gulf, there was talk of a 35,000-dwt fixing around $12,000 for a trip to the Continent with woodchips. In Asia, a 34,000-dwt 2012-built open CJK was booked earlier in the week for a run via CIS and redelivery in Southeast Asia at $8,000. A 32,000-dwt 2011-built open South China was fixed to load in Vietnam and redeliver in the Persian Gulf at $8,000, and a 28,000-dwt open in the Philippines was fixed via Indonesia to Japan with coal also at $8,000.

Sources: The Baltic Briefing

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

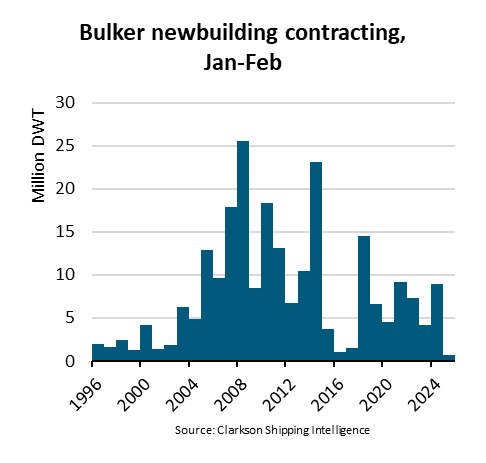

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar