1.Global energy giant Royal Dutch Shell Plc has announced plans to triple the number of gas stations it has in China to 3,500 by 2025, in response to the recent lifting of restrictions on foreign investment in the sector.

2.Port of Rizhao's net profit is 355 million yuan in the first half of 2018,increasing 56% year-on-year.

3.China National Petroleum Corp (CNPC) and Myanmar Oil and Gas Enterprise jointly own Myanmar-China pipeline that extends 470 miles (771 km) northwest to Kunming where PetroChina owns a 260,000bpd refinery. It allows China to import crude faster from the Middle East and Africa.

4.The American Petroleum Institute (API) focused on the counterproductive effects of Section 301 tariffs on America’s natural gas and oil sector,mentioning that the Chinese retaliatory tariffs will damage US LNG exports.

5.The IMO's new regulation for the world's ocean-going vessels to use fuel with a maximum sulphur content of 0.5% down from 3.5% starting from the beginning of 2020 could push up diesel prices by 20 to 30%,according to the International Energy Agency.

6.Hong Kong-listed box manufacturer and logistics operator,Singamas Container Holdings has blamed rising material costs and the appreciation of the RMB for a US$2.1m loss in the first half of 2018,despite revenue of US$969.22m. In 2017 the company recorded a US$19.9m profit.

7.COSCO has acquired a majority stake in Spain's largest maritime terminal operator,Noatum Ports,which manages a pair of maritime terminals in the cities of Valencia and Bilbao,as well as dry terminals in Zaragoza and Madrid.Many locals believe continued investment from Chinese companies can create more jobs and business opportunities in the future.

8.Unconventional reservoir technologies and data analytics are key to boosting oil and gas exploration and production in China,according to a senior executive of United States energy company ConocoPhillips.

XINDE MARINE NEWS editor:Anita

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

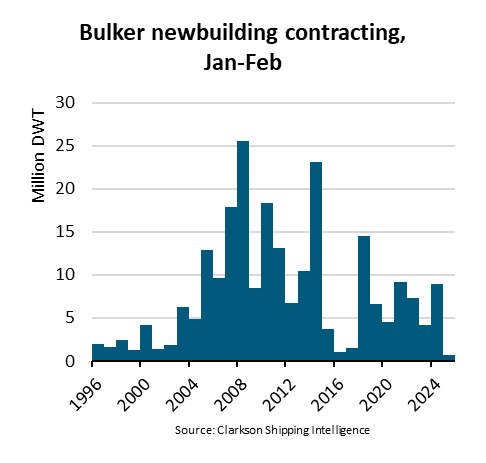

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar