Over many years the commercial insurance market gas sought to get a share of the massive P&I business overwhelmingly dominated by the Mutuals of the International Group. In recent years the International Group of P&I Clubs have endeavoured to push back their commercial rivals.

Noting this change Lloyd’s broker, Tysers states in it latest P&I report: “…the development of fixed premium options for smaller vessels by the P&I Clubs, such that all the International Group now offers fixed cover in one way or another, leaves one to question whether there is any continued demand for offerings from the commercial market.”

Evidence to back this assertion might be found in the demise of traditional fixed facilities, Osprey and Navigators. Both facilities failed to grow sufficiently to be sustainable and instead were swallowed up by Thomas Miller Speciality, a subsidiary of the UK Club’s managers.

There is a perception that fixed premium cover limits itself to small brown water or coastal vessels but while there are obvious limits these are greater than some may surmise. Ranked the safest option in the commercial market by Tysers, British Marine, acquired by QBE in 2005, offers limits up to US$1bn for vessels up to 20,000 GT. With annual premium income of around US$100m, the facility has a history of handling multi-million dollar claims.

According to Tysers the runner up is Amlin/Raetsmarine. Raetsmarine, now fully integrated into Amlin, also offers limits up to US$1bn. Tysers hints there may be risks associated with this facility, noting that it is “not very fussy, as it “appears to be willing to cover any type of vessel regardless of age or class.”

Tysers suggest caution in the case of Lodestar. Ryan Specialty Group of the US purchased this facility in February 2018. Lodestar offers limits up to US$1bn for vessels under 40,000 GT.

“Whilst service levels have generally been satisfactory, we are concerned at the staff turnover which has seen good underwriters and claims handlers move elsewhere with worrying regularity,” Tysers remarks.

Posing the question: “Does the shipping community still need alternatives to the International Group, Tysers suggests no, for the following reasons:

The ship owner who due to the nature of his fleet or trade, feels he does not need high limits of liability or the full range of mutual services and can find cheaper insurance outside the International Group. Check again, you will be surprised at the competitive approach of the Clubs and the low cost of high limits.

Owners who distrust mutuality

– the potential for unbudgeted supplementary calls and the need to pay release calls to leave. A reasonable point of view, but no Club has had an unbudgeted call since 2010 and many are returning premium. The Clubs have never been so financially strong. Release calls remain a bone of contention, but are slowly declining. If you are still averse to mutuality and your tonnage fits the criteria, go fixed with a Club or talk to British Marine.

Owners who want a ticket

to trade and would not buy insurance in the absence of regulatory requirements. Go for the cheapest option in the fixed market, take a high deductible/ low limit and do not expect too much by way of service.

Owners with vessels, which the IG will not write. Mainly old, larger vessels of dubious class, or singletons. Find whatever cover you can and good luck with the claims.

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

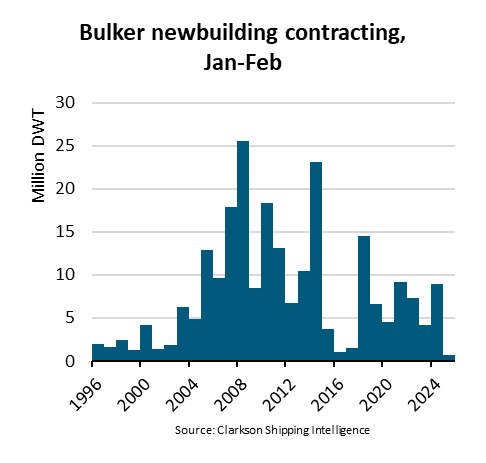

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar