Global VLCC freight rates are expected to be well supported this year and in the next as a large number of them will go for maintenance, and also install a ballast water treatment system at a time when there is also more demand to move crude across continents, a senior industry analyst said.

In the run-up to the implementation of new norms on sulfur emissions from marine fuels, refineries are ramping up and reconfiguring their capacities to cater to the likely strong demand for LSFO and Marine Gas Oil, Ralph Leszczynski, director for research in Genoa-based Banchero Costa, said in an interview on the sidelines of the MARE Shipping Forum in Singapore earlier this week. Banchero is a global shipping brokerage and consultancy.

The upward impact on freight rates will be more evident in the second half of this year when crude shipments spike to meet additional demand as many of the refineries are currently tweaking their plant and machinery to optimize production of LSFO and MGO, Leszczynski said.

Under IMO regulations, it will be mandatory globally to cut sulfur emissions from marine fuels to 0.5% from next year compared with the current 3.5%.

Demand for MGO can at least double next year and to produce such volumes, more crude may be needed, he said, adding that more crude is already being loaded for export from the US. He pointed out that such long haul voyages from US to Europe and Asia will keep VLCCs occupied for a longer duration and drive up rates.

World scale rates for VLCCs on the benchmark Persian Gulf-China route were assessed at w63.5 Wednesday, little changed from w63 at the beginning of the year, according to S&P Global Platts data.

VLCC rates are being held back because of a slew of new buildings that have been delivered over the past two months. Due to heavy slippage from the previous year, more than 20 million wt of new dirty tankers were delivered in 2018, around 60% of which comprised VLCCs, Leszczynski said. Similar projections have been made for this year and the next.

Higher production and trade in MGO implies that there will be more demand for clean tankers as well, he said.

LSFO and MGO, as the fuel of choice, have gotten a boost as Singapore and several ports in Europe and China have already banned the release of excess sulfur from open loop scrubbers in their territorial waters.

SCRAPPINGS AND MAINTENANCE

A major factor that will help reduce supply is the special survey maintenance that ships have to undergo every five years and the phasing out of ships that are 14 years old or more.

Around 160 VLCCs will require a special survey and install a ballast water treatment system next year, up 14% from this year’s projections, according to Bancosta’s data. This will keep these ships onshore for a few weeks and thereby reduce supply.

“Owners are strongly encouraged to install the ballast water system earlier rather than at the last moment due to equipment supply constraints,” Leszczynski said.

The new ballast water norms came into force in September 2017 and while they have to be met immediately by new ships, for the existing fleet at that time, an implementation timetable has been agreed, based on the date of the ship’s five yearly special survey. In other words, until 2022, several ships in the current fleet will be dry docking to get the BWTS installed.

BWTS are expensive and can cost up to $3 million, Leszczynski said, adding that this will serve as a deterrent for owners of older ships.

“Owners will install BWTS in their ships only if they are confident of recovering their costs, or else they will just scrap them,” he noted.

Demolition activity was extremely strong last year with close to 90 dirty tankers scrapped, a third of which were VLCCs, Leszczynski said.

“The trend will continue this year and the next due to sub-optimal market conditions, fleet renewal and the impact of new regulations such as on sulfur emissions and BWTS,” he said.

Going forward, demolition activity is also expected to remain strong because of the age profile of the ships. More ships have been built in the early-2000s compared with the 1990s, and less than a third of the 37 VLCCs built in 2000 have been scrapped so far, he added. The double hull ships of the post-2000 generation have hardly been scrapped, he said.

At a time when 3% of the trading fleet is over 20 years old, and more than a fifth between 15 and 19 years of age, and new ships are being added to the fleet every week, time is ripe to accelerate scrappings, Leszczynski said.

Source:Platts

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

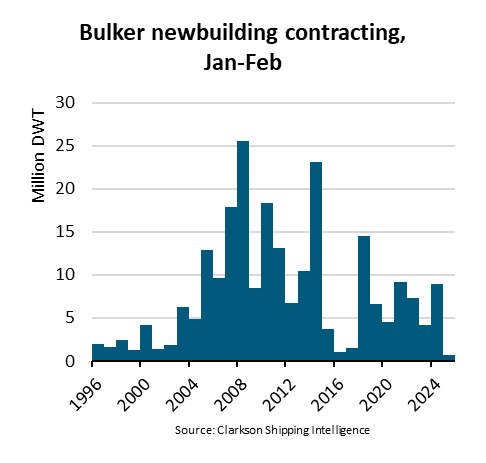

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar