The world is awash in stories and headlines about the pandemic, inflation and central banks poised to raise interest rates, yet the global oil balance is tightening and upward pressure on oil prices is intensifying.

In analyzing the world's oil supply and demand balance, one has to account for about 85 countries that produce oil and about 160 consuming nations. Despite the size of the numbers, all supply and demand fundamentals ultimately intersect at storage, specifically petroleum inventories held by the Organization for Economic Cooperation and Development. Petroleum stocks in these countries are, in fact, the proxy for global storage.

From July 2020 until the end of last month, total petroleum inventories in the OECD shrank by 390 million barrels. This draw on storage, while in line with our forecast, far exceeded the consensus expectation and stands as the largest inventory draw in recorded history (monthly data for inventories began in 1984). We have a couple of weeks to wait before generating an estimate for September, but partial data shows the draw pattern persisting.

Two-thirds of global oil inventories are held by the OECD Pacific and North America regions. During the first half of September, inventories collectively drew down by 36 million barrels, according to our estimates. Though the figure is preliminary, this estimated draw is nine times larger than the typical draw for the full month. Inventory changes for these two regions also show a near perfect correlation with changes in global storage.

There are other moving parts in the equation, but the above inventory estimate suggests global oil demand is running ahead of forecast. This seems particularly notable given evident financial market concerns about the effects of the fourth wave of the pandemic. In fact, global oil demand exceeded our forecast in June, July and August.

Because all supply and demand fundamentals intersect at storage, inventories and oil prices demonstrate a strong inverse relationship. The pattern is so pronounced that the mirror image between oil prices and storage can be modeled econometrically. Based on the latest weekly level for stocks, our proprietary model generates a current “fair value” for Brent crude of almost $88 per barrel, $11 higher than last week's closing price.

As a final point of discussion, indications over the past week suggest 12-14 percent of US Gulf of Mexico crude production will remain offline until the first quarter of next year. The outages are related to damage caused by Hurricane Ida and led us to lower our already below-consensus forecast for non-OPEC oil production.

This downward revision in non-OPEC supply will steepen the fourth quarter’s already larger-than-normal inventory draw. As things stand, the coming quarter’s pull on storage will be about three times higher than normal. This is expected to lift crude prices materially from current levels, and we expect it will have a highly bullish effect on instruments leveraged to oil prices, such as energy equities.

Source: Arab News

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

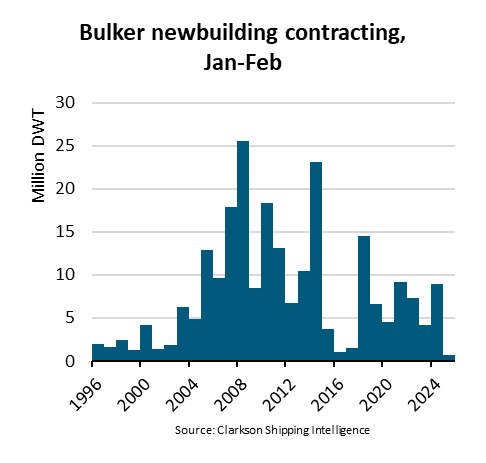

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar