Container shipping market

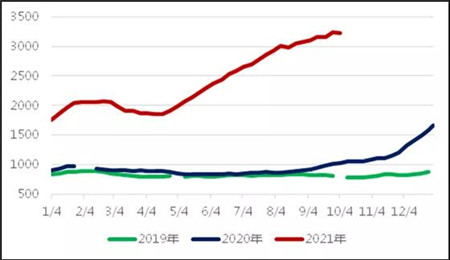

2019-2021 CCFI Trend Comparison Chart

In October, the off-season of the market is not low. According to the latest statistics, the inventory-to-sales ratio of US retailers in July was only 1.11, and inventory replenishment activities will continue. From August 2021 to January 2022, the import volume of containerized cargo at the Port of Los Angeles and Long Beach in the US West will increase by 2.7% from February to July 2021.

According to the statistics of Marine Exchange of Southern California, at the end of September, there were 65 container ships waiting to enter the port outside the Port of Los Angeles and Long Beach, and the congestion was spreading to the ports of the East and the Gulf of the United States. Whether it is import demand or logistics bottlenecks, it will not be alleviated in the short term, and the container shipping market in October may continue to maintain its current high level.

Tanker transportation market

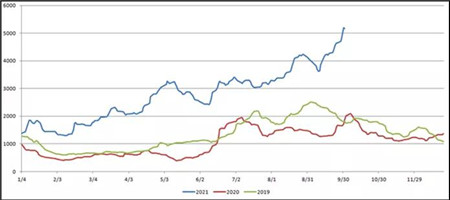

2019-2021 Middle East to China TD3C route WS trend comparison chart

In the short term, with the arrival of the winter heating season in the northern hemisphere and the successive lifting of the epidemic blockade in Asian countries, the freight rate of the tanker market is expected to pick up slightly in the fourth quarter. In the long run, thanks to the increase in the coverage of the COVID-19 vaccine and the progress in the development of new drugs, global crude oil demand is expected to slowly recover.

At present, the three major institutions are in disagreement on the market prospects in 2022: OPEC expects global oil demand to increase by 4.15 million barrels/day in 2022, an increase of 870,000 barrels/day from the previous month; IEA maintains its expectations of an increase in demand of 3.2 million barrels/day; EIA expected the growth rate is 3.63 million barrels per day, a decrease of 10,000 barrels per day from the previous month.

BIMCO analysts believe that the scrap rate of around 1.6% still needs to be further improved to effectively support the full recovery of the market.

According to Clarksons' forecast, in 2022, the demand for crude oil will increase by 5.6% and the supply will increase by 5.2%. Among them, the demand for VLCC will increase by 5.9% and the supply will increase by 5.9%.

Dry bulk shipping market

2019-2021 BDI trend comparison chart

In September, the Clarksons market report showed that the weighted average revenue of dry bulk carriers reached $38,290 per day on the 24th, reaching the highest point since 2008.

It is estimated that in 2021, the global dry bulk shipping volume will grow by 4.6% and the fleet growth rate will be 3.4%. In 2021, the global dry bulk shipping volume will grow by 3.7%, and the total will reach 5.36 billion dwt.

In terms of cargo types, due to China's emission reduction and production restrictions, the growth rate of iron ore shipments in 2021 is expected to be 1.5% to 2%; The coal market is supported by the increase in imports from the European region, and the growth rate of shipments in 2021 will reach 5%. %; The grain market is supported by China's demand and the peak export season of the Atlantic market, and the annual growth rate of shipping volume will reach 2%, with a total volume of 524 million dwt.

Source: Sarah Yu, XINDE MARINE NEWS

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

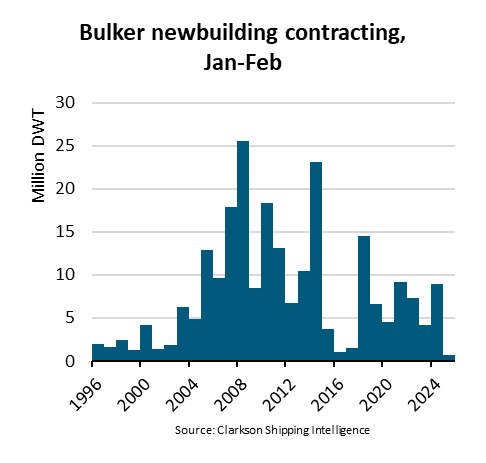

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar